In the long term, buying shares at current levels will likely prove to be a smart move. See the graph below.įigure 3: AAPL performance from August 2015 to August 2016.įor this reason, I have not changed my stance on AAPL. Despite Apple shares having recovered by as much as 16% in one single trading session, (1) volatility remained very high, and (2) returns were disappointing over the following 12 months. Take the August 2015 example mentioned above. And because volatility is a reflection of weak markets, further drops in share price are certainly not out of the question. I have been arguing repeatedly that, in the short term, AAPL investors should expect more volatility. The problem is that Thursday’s rally might not mean that bulls are ready to take over from here. There is nothing wrong with Apple stock turning a 2.4% loss at the worst of the day into a 3.4% gain at the end of the session. At least I find this explanation more plausible than the idea that investors might have capitulated and decided that the CPI report did not look as bad as they originally thought. Of course, this is just speculation on my part. That might have been enough to unleash a buying spree that became self-reinforcing.

#NEWSFLOW WINDOWS PHONE KEYGEN#

Once the bets paid off in the morning, traders probably moved quickly to close their short positions.

Traders probably placed bets against stocks ahead of the inflation print, which helps to explain why the S&P 500 had been down nearly 5% over the previous five trading days. I suspect that market mechanics were to blame (or credit) for the phenomenon. It is not clear what triggered the rally. All of a sudden, a bullish tide sent every sector and most stocks much higher. The S&P 500 ( SPY) – Get S&P 500 ETF TRUST ETF Report, very early in the trading session, dropped 2% from the previous day’s close. Given the bad news, why didn’t stock prices fall then? Well, they did. In both cases, the readings were worse than most had been projecting. The core inflation measurement, which excludes volatile energy and food prices, increased 6.6% and 0.6% YOY and compared to August, respectively. The headline number climbed 8.2% YOY, about 10 basis points above expectations.

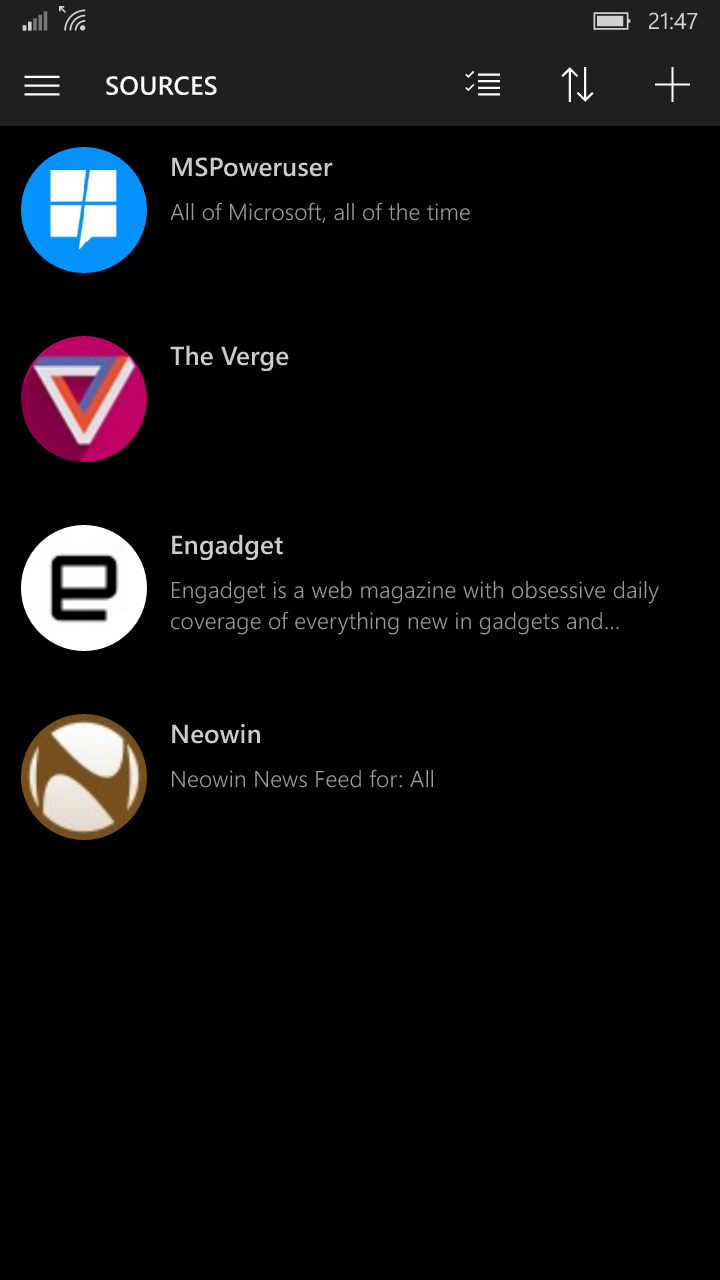

inflation to the consumer index) report came in hot once again. Those who followed closely the news flow must know why trading was so volatile on October 13. A “gap up” or “gap down” can also be very large, especially around earnings day and other important events. same day) is different from an overnight gap (closing to opening bell, i.e. AAPL bounced nearly 16% from the lows of that day to the peak, but retreated and ended the session down 2.5%.įor clarity, an intraday swing (opening to closing bell, i.e. Back then, investors were spooked over growth deceleration in China, a market to which Apple was (and still is) heavily exposed. Out of curiosity, the wildest ride for Apple stock within a single day in the past decade happened on August 24, 2015. Application features friendly and informative user interface, first app'll help you to find newswires on your favorite websites or globally - with keywords and then will start collecting news.Figure 2: AAPL distribution of intraday swings, last 10 days. Newsflow app downloads news from RSS feeds directly to your device and stores them locally, so you'll be able to read them at any time whenever you want. Newsflow brings all news of your favorite websites in one place, so you don't have to spend time on web browsing any more, you'll always be in touch with the latest news and articles from around the world.

0 kommentar(er)

0 kommentar(er)